24+ gift funds for mortgage

Web The annual exclusion for 2018 and beyond is 15000 per person who was gifted money and in 2022 this amount jumps to 16000. Ad Compare More Than Just Rates.

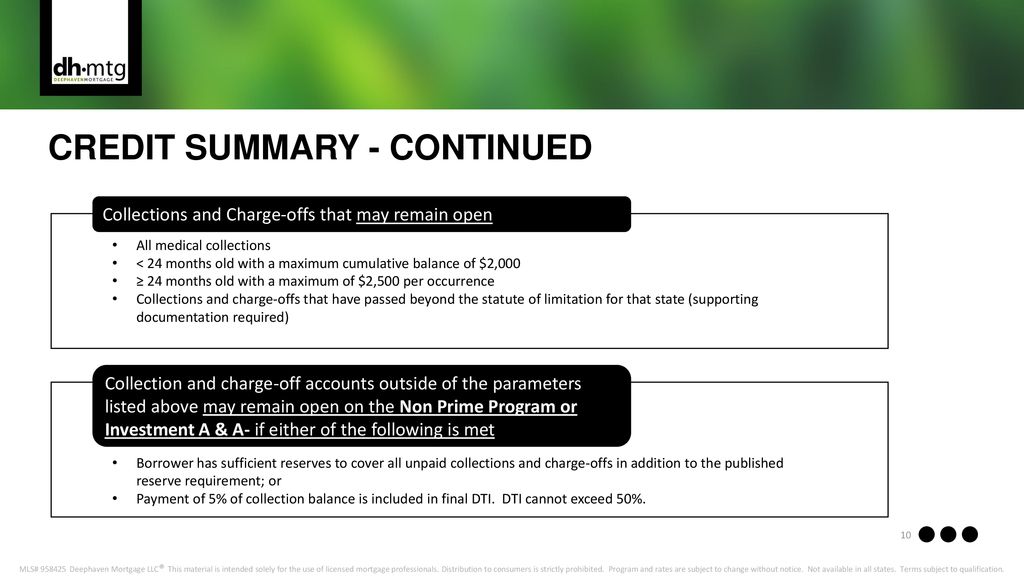

Delegated Underwriting Training Ppt Download

Following are the specific.

. See if you qualify. Not all programs are the same. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Web For an FHA loan the entire down payment amount can be gifted. Web Gift funds can only be used on primary homes and second homes not investment properties. Gifts letters are common in financing the down payment for a home.

Web If you apply for an FHA loan your gift funds must be from family or another eligible donor. Web The annual exclusion per individual recipient is 16000 for 2022 so if your gift exceeds that the donor will have to file a gift tax return. Conventional Loans all of your down payment may be gifted if.

Web Tax Implications for the Giver of a Down Payment Gift. The mortgage lender needs to. Find A Lender That Offers Great Service.

These exclusion amounts will remain in effect until at least 2025. This gift will go against their. The IRS imposes a gift tax on certain monetary gifts and this tax is paid by the person donating the money.

Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Compare Apply Directly Online. Web For married taxpayers filing joint returns it is 30000.

For instance if a donor gave. Web The first step is to determine how much the loan program you plan to use will allow you to use for gift funds. Ad Check Todays Mortgage Rates at Top-Rated Lenders.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Cousins nieces and nephews are not able to offer gift money under standard family. Web Lenders want to protect themselves against default by making sure the gift money is what it appears to be eg.

A gift not a loan and the borrower can afford the. A bank record offers proof of a gift which. Ad Dedicated to helping retirees maintain their financial well-being.

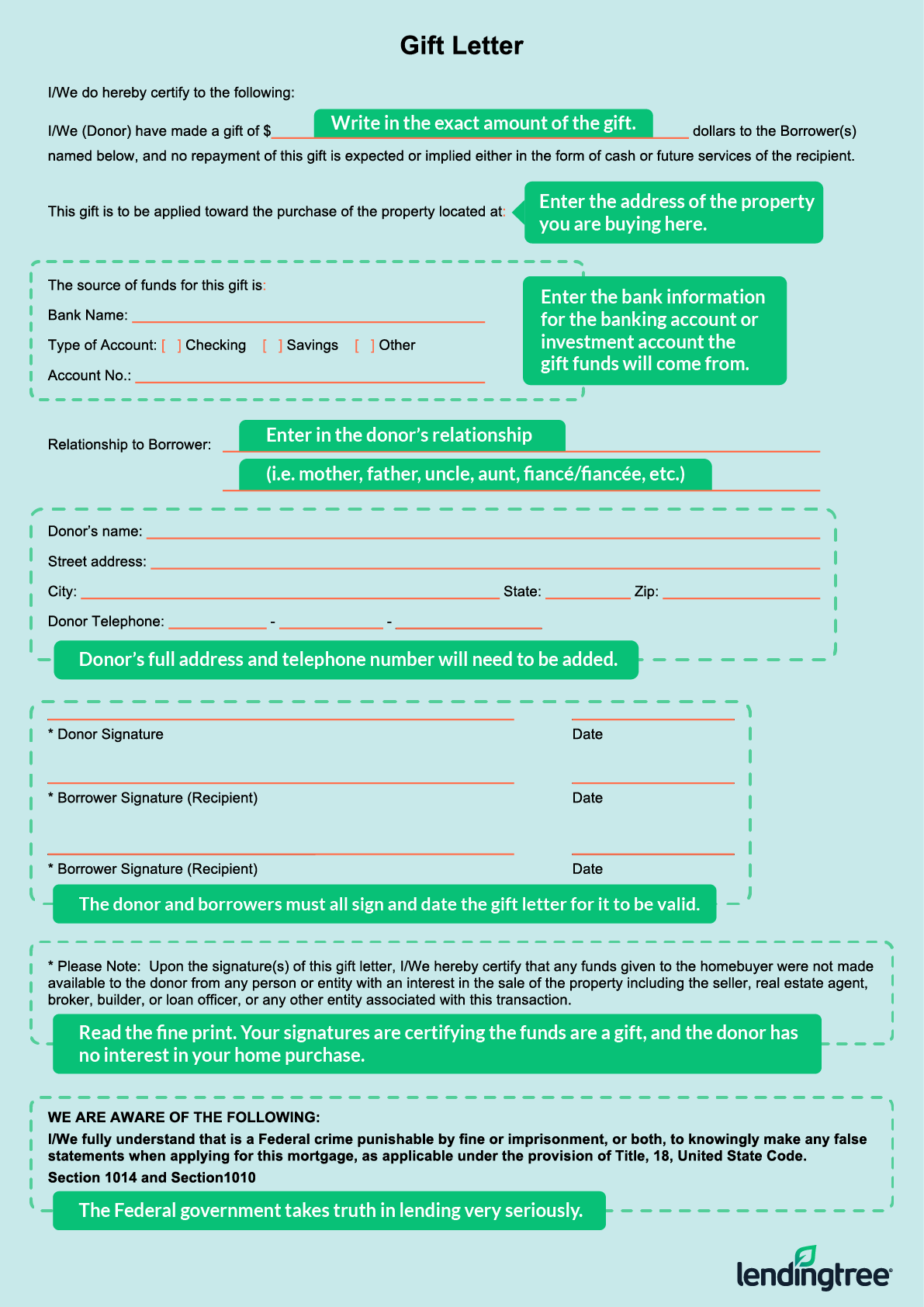

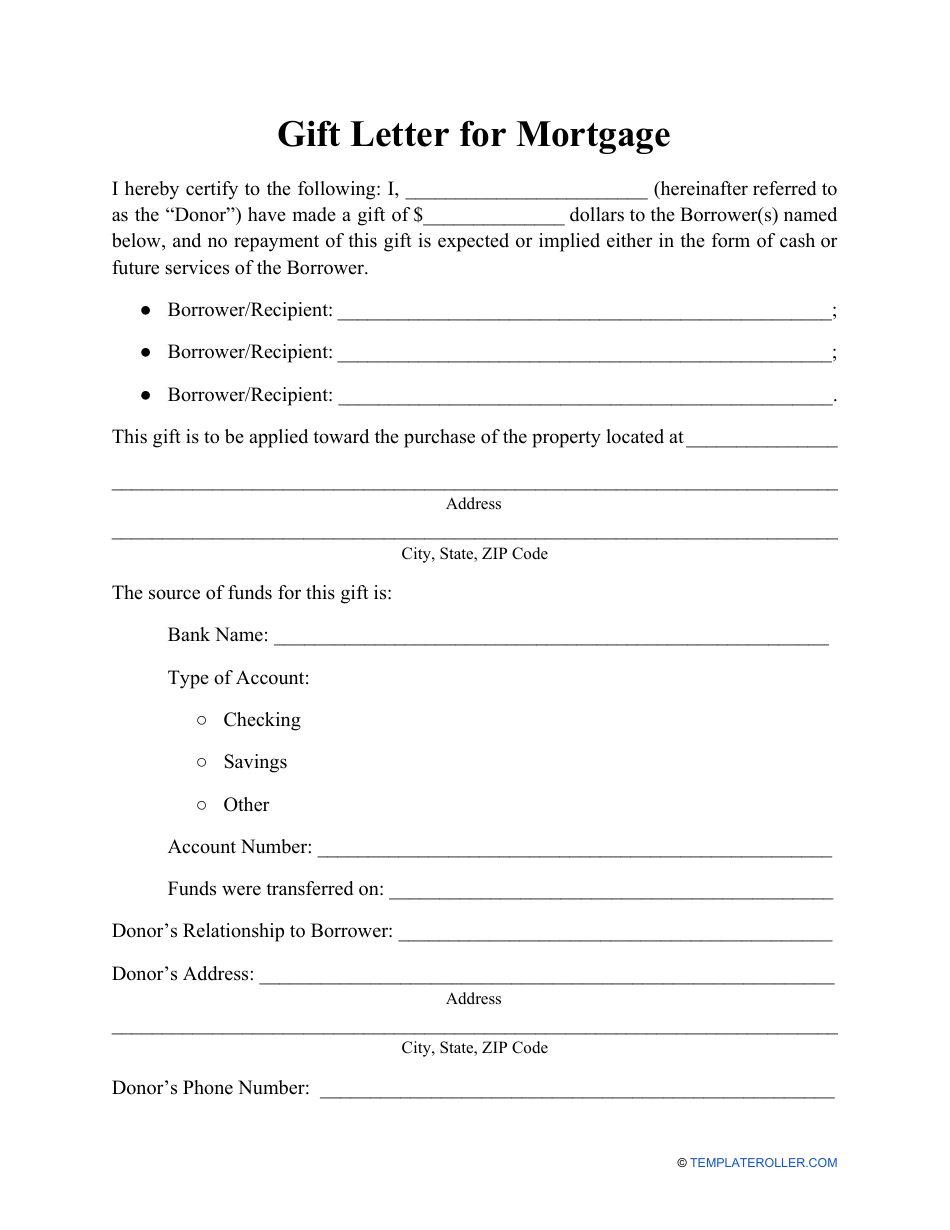

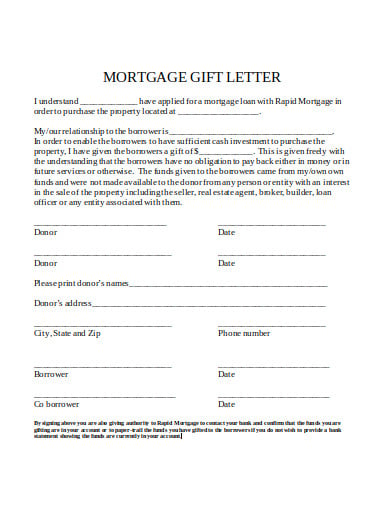

Web Per Gift Funds Mortgage Guidelines homebuyers can get a gift from a family member for the down payment andor closing costs on a home purchase. Web A gift letter is a document that helps satisfy the requirement that a borrowers down payment funds come from legitimate sources. The lifetime exemption as the name suggests is the.

Web The lender needs to know that the money is a gift and not a new loan which could hurt your ability to repay the mortgage. Web Find out the benefits and drawbacks of using gift funds towards your mortgage. All of the down payment can also be donated for a conventional loan if the down payment is more.

Web A borrower of a mortgage loan secured by a principal residence or second home may use funds received as a personal gift from an acceptable donor.

Using Gift Funds For Your Mortgage Down Payment Morty

How To Complete A Gift Letter For A Mortgage Lendingtree

Free 5 Sample Mortgage Commitment Letter Templates In Pdf Ms Word

Gift Letter For A Mortgage What To Know And How To Use One

Non Prime Select Guidelines Call Jesse B Lucero 702 551 3125

Using Gift Money For A Down Payment Chase

Gift Letter For Mortgage Template Download Fillable Pdf Templateroller

Fha Gift Funds Definition And Guidelines Rocket Mortgage

Cmp 15 11 By Key Media Issuu

:max_bytes(150000):strip_icc()/rules-for-documenting-mortgage-down-payment-gifts-4157907-FINAL-9c59d5c0b3e445e1a142b323f35176e1.png)

How To Document Mortgage Down Payment Gifts

Gift Letter For A Mortgage What To Know And How To Use One

Mortgage Down Payment Gift Rules Who What Why A Letter

Jtl6gez7cboyqm

Using Gift Money For Your Down Payment Mitch Saul S Mortgage Report

Fha Gift Funds Guidelines 2023 Fha Lenders

10 Mortgage Gift Letter Templates In Pdf Word

4 Fibs You Should Never Tell On A Mortgage Application